Connected TV in Europe: Balancing Growth, Privacy, and Innovation

Connected TV (CTV) is currently experiencing meteoric growth across Europe, transformed by viewers now consuming their content through Smart TVs, Set-Top Boxes, Streaming Devices, and Gaming Consoles.

With over 80% of European households with connected TVs now preferring CTV to traditional linear television, the industry stands at a crucial intersection of commercial opportunity and data protection challenge.

A growth story

Recent data from Freewheel's Market Report highlights the dramatic expansion of CTV in the UK and Europe. Currently accounting for 46% of all ad-supported premium video content views, CTV has witnessed a remarkable 31% year-over-year increase. This growth trajectory shows no signs of slowing, with projections indicating a continued 20% annual growth through 2025.

With younger viewers flocking to Free Ad-Supported Streaming TV (FAST) category, it’s easy to see why advertisers are following suit, recognizing the powerful combination of traditional TV's impact with digital advertising's data-driven results.

Yet, CTV’s rapid growth in programmatic advertising brings complex challenges, in privacy and advertising-compliance. Where an ecosystem is challenged to agree on common policies and standards, viewer data practices and privacy experiences become fragmented, too.

Lingering challenges

As we discussed last September, he IAB EU Transparency and Consent Framework (TCF), the industry tech-policy framework for ensuring that data processing associated with programmatic advertising is meeting GDPR and ePrivacy Directive requirements, does not explicitly support CTV due in large part to the platforms' penchant for proprietary standards.

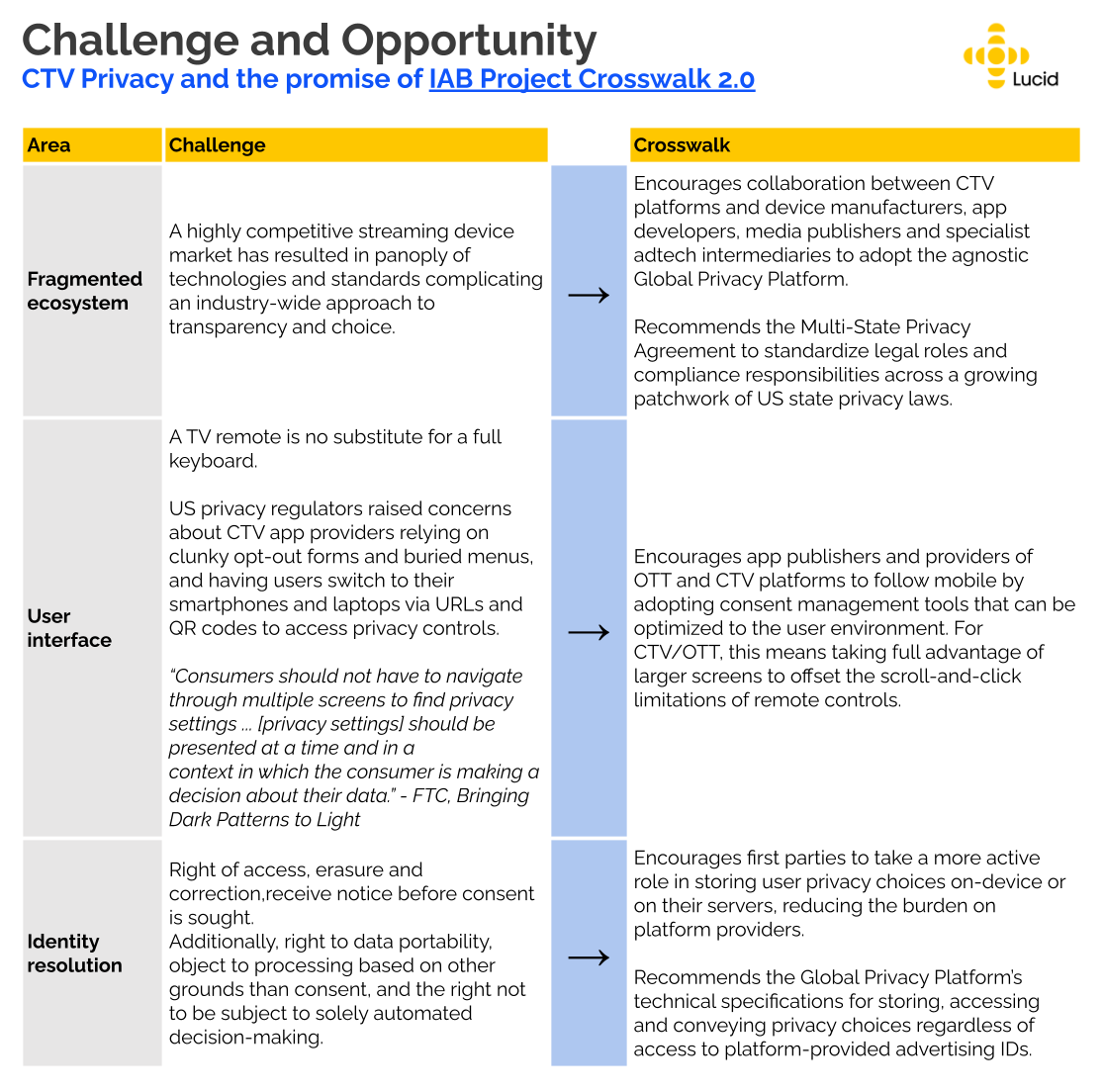

Enter the IAB’s Project Crosswalk 2.0, a genuine effort by the Crosswalk working group to solve the complicated issues of accountability and interoperability facing CTV.

While promising, Project Crosswalk seems to have stalled out. Whether this is from platforms’ ‘rugged individualism’ or broader industry issues is hard for us to say, but it helps to see a connection between CTV… and GPP.

- Adoption. This IAB Tech Lab has been beating the Global Privacy Platform (GPP) drum for over a year. But with adoption challenge by, among other reasons, integration difficulties, CTV denizens may be justified in taking a wait-and-see attitude to TCF-flavored compliance.

- Competing motives. With ballooning streaming content spending, platforms are pressured to derive ad revenues from paying subscribers too. An easier, more consistent and persistent way for users to opt-out of ads is antithetical to those goals.

Personal, switchable and household-identifiable

To avoid any doubt, CTV ads – as enabled through various platforms, apps and intermediary ad tech partners – involve personal, if pseudonymous and household level, data.

The targetable data mix can include household level demographics, web and mobile interest data, advertiser-supplied 1st party data, viewer behavioral data, and 3rd party data ‘enriching’ the resulting audience segments. There are natural concerns that how the data is collected and made useful for advertising is not made sufficiently transparency and actionable for viewers.

As global privacy regulations become more complex, CTV platforms must be thinking about Privacy by Design to ensure their products can comply, but can also do so interoperably.

It isn’t enough for CTV providers to obtain informed, freely-given consent from users before leveraging their data for personalized advertising or content recommendations. Per the GDPR, these choices must be purpose specific and representative of other parties who need the user’s consent or opportunity to explain their legitimate interest in receiving user data.

Let's also not forget about the threshold consent required under the parallel ePrivacy Directive to store or retrieve data on the connected device.

The Digital Markets Act layers additional transparency and fairness requirements on CTV providers, particularly the large ‘smart’ platforms that may qualify as gatekeepers, requiring substantial technical and operational changes that affect market dynamics too.

Users first

To an industry where cookies were never a ‘thing’ and local storage may not be available to an app developer, alternative identifiers (and server-to-server data flows) become particularly attractive.

For example, Automatic Content Recognition (ACR) technology has become a potential game-changer, as the technology enables real-time identification of content being viewed, allowing for targeted advertising and detailed audience analytics. But while ACR technology enhances personalization, it still raises privacy concerns.

In today’s identity landscape, CTV advertisers can leverage tokenized emails and phone numbers household ‘living unit’ IDs, mobile and CTV ad IDs, proprietary platform IDs and other kinds of identifiers to drive and measure business outcomes. While this opens the field for identity resolution providers who can stitch all these IDs together for advertisers to target against, the user’s privacy experience becomes decidedly more cumbersome.

- If you are a Samsung Smart TV user, do you know that you can reset Tizen ID for Advertising (TIFA)?

- Did you also know that you first need to reset your Samsung Personalized Service Identifier (PSID), which will in turn reset the TIFA?

As a user, you may be forgiven for not knowing you could -- there isn’t nearly as much education out there about controlling these identifiers as there is about mobile ad IDs. And there lies a part of the privacy problem, and why a set of cross-industry privacy controls that are inclusive of CTV’s particular needs remains a good idea.

To address these UX concerns, we are seeing the rise of the TV-optimized (and Google certified) Consent Management Platform such as by SourcePoint, offering settings that can be navigated with a remote control or a Bluetooth mouse.

To Samsung’s credit, they are “working towards simplifying settings menu options for Smart TV users, and in a future release this may change from Reset PSID to Reset Advertising ID.”

If you build it, they will come

The CTV industry has been responding to these regulatory and cross-industry challenges.

For example, the European Programmatic TV Initiative (EPTVI) is working to defragment CTV programmatic ad protocols and technology infrastructure, while the Digital Advertising Alliance (DAA) has rolled out detailed guidelines for applying the AdChoices icon to CTV platforms. Together, these efforts aim to build on Project Crosswalk’s foundation, delivering the transparency and control users already expect in web and mobile environments.

Ultimately, CTV’s privacy success hinges on industry-wide adoption of privacy-compliant identification, robust consent management systems, and standardized data flows. But all of this depends on one thing: CTV users buying into these improved privacy measures too. It might take a major platform—perhaps one trailing in CTV revenue—to give these initiatives the push they need. Until then, we wait. Also for season two of Severance.